What happens after we divest from fossil fuels?

Dario Kenner, 13 February 2014

Summary: Fossil fuel divestment campaigns are gathering momentum. What if investors were convinced to divest? In the long-term they will probably shift their investments to renewable energy but we cannot rely on the assumption that divesting from fossil fuels will automatically reduce global emissions fast enough to tackle climate change. This is because investors may switch to carbon intensive non-energy investments and might not choose the cleanest forms of renewable energy.

This blog looks ahead to a scenario when (hopefully) there is a consensus that there must be a dramatic reduction in the burning of fossil fuels and all governments have agreed a global deal to cut greenhouse gas emissions. We are clearly not at this point yet. The purpose of this blog is to generate debate by exploring what investors’ might do if they were to divest from fossil fuels.

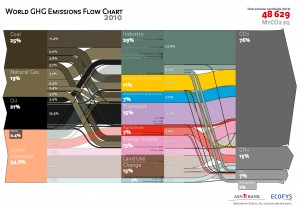

In September 2013 scientists confirmed human activity is causing the climate to change and that we urgently need to reduce greenhouse gas emissions, around 65% of which come from burning fossil fuels. The argument underpinning the growing fossil fuel divestment movement is that over 2/3rds of the world’s reserves of oil, coal and gas are ‘unburnable’ if we are to prevent global temperatures increasing by 2°C – and therefore improve our chances of avoiding runaway climate change.

The list of actors warning of this approaching ‘carbon bubble’ is growing. It now includes Al Gore and HSBC, and divestment has been identified as one of the key investment trends to watch in 2014. Currently several universities in the United States have agreed to divest along with a number of religious institutions and the cities of Seattle and San Francisco.

Most divestment campaigns want investors to shift their money away from oil, coal and gas and put it into clean renewable energies and energy efficiency initiatives. But choosing which renewable energy to invest in is not as straightforward as it seems. The most commonly known sources such as solar and wind are broadly agreed on as being clean – although it’s true that energy is needed to make a solar panel or a wind turbine in the first place (see discussion on energy returned on the energy invested).

There is more debate about how “clean” other sources really are because large-scale hydropower, burning biomass and clearing forests for biofuels also lead to carbon dioxide emissions (see arguments that each one is clean here, here and here). It’s often the scale and the origin/destination of these energies that are important factors e.g. emissions if they need to be transported long distances. So while we urgently need to find alternatives to fossil fuels, we also need to recognise the pros and cons of each renewable energy, especially in the quantity of emissions they release, before we scale them up globally.

Non-energy investments

With the world population predicted to be over 9 billion by 2050, the International Energy Agency predicts energy demand could double by 2050. With or without fossil fuels demand for energy is clearly growing and so it’s reasonable to assume that in the long-term a significant chunk of re-invested fossil fuel finance would be in renewable energy.

But there is no guarantee that in the short-term the majority of funds would automatically be re-invested in renewable energies. This is partly a practical issue that is regularly talked about. At the moment there is not enough renewable energy to invest in. In 2012 renewable energies provided around 10% of energy consumed globally, compared to 87% from coal, oil and gas. In 2013 investments in renewable energy totalled around $245 billion, with the head of the UN climate change negotiations Christiana Figueres calculating around double that amount is being invested in fossil fuel projects. To give you an idea of how small the $245 billion figure is the OECD estimates large investors hold around $76 trillion in assets. Another area to watch are green bonds. $10 billion were issued in 2013 and are set to grow in 2014. Observers note they could be key to increasing the volume of investment in clean infrastructure.

In the meantime until renewables can offer good returns a potential scenario is that investors would look for other high earning investments if they had to shift away from fossil fuels. Usually such “safe” investments are in areas like US government bonds and commodities e.g. gold. The problem is that these investments could 1) end up in other economic sectors associated with high carbon emissions, and/or 2) delay the transition to renewable energy.

An estimated 30% of emissions are caused by deforestation and converting land for agriculture (credit: Antonio Cruz da Abr)

1) There is a danger that funds divested from fossil fuels could still end up causing carbon emissions because they go to other high earning carbon intensive sectors such as commodities. Let’s take one hypothetical example. Money is divested from an oil company but is then re-invested in a mining company that deforests part of a tropical rainforest to mine for gold. The reason this is important is that this would contribute to the estimated 30% of emissions that come from deforestation and converting land for agriculture.

A quick look at the market value of the world’s biggest companies shows mining and metals companies are right up there – along with technology, communications, food, beverages, pharmaceuticals and banking. It would be interesting to know what the full carbon footprints of these economic sectors are (energy and non-energy) because they use a lot of inputs to make their products, some of which like metals and food are direct drivers of deforestation, and then transport them huge distances all over the world.

2) Jeremy Rifkin estimates it could take around 40-50 years to build/retrofit the global infrastructure for the generation and distribution of renewable energy but our time is running out to effectively reduce greenhouse gas emissions to deal with climate change. A recent draft UN report reveals we will need to reduce emissions by 40-70% by 2050 to try and keep below a 2°C in global temperature (which is itself heavily contested as the “safe” limit to prevent the impacts of climate change). The quicker we shift the global energy infrastructure to work with renewable energy, the more likely we are to get to a point where we lock in renewables as our main energy source. As renewables become the dominant energy it will hopefully reduce the likelihood of the investors that choose to divest being replaced by others who still want to make money from burning fossil fuels.

After divestment

Of course it’s actually very difficult to predict how investors would react to re-investing away from fossil fuels because they are diverse with different international portfolios and appetites for risk e.g. a hedge fund could decide to invest in renewables while a pension fund has to deliver guaranteed returns from “safe” investments. The speed at which investments transition from fossil fuels to renewables (e.g. if oil and coal were to rapidly lose their value when the carbon bubble bursts) could also affect investor behaviour in terms of seeking safe havens or choosing more “risky” renewables. My point is that it would be useful to explore how investors’ options in a post-fossil fuel dominated world could play out. We cannot rely on the assumption that divesting from fossil fuels will automatically reduce global emissions fast enough because investors may switch to carbon intensive non-energy investments or renewable energy sources that cause significant emissions.

Of course it’s actually very difficult to predict how investors would react to re-investing away from fossil fuels because they are diverse with different international portfolios and appetites for risk e.g. a hedge fund could decide to invest in renewables while a pension fund has to deliver guaranteed returns from “safe” investments. The speed at which investments transition from fossil fuels to renewables (e.g. if oil and coal were to rapidly lose their value when the carbon bubble bursts) could also affect investor behaviour in terms of seeking safe havens or choosing more “risky” renewables. My point is that it would be useful to explore how investors’ options in a post-fossil fuel dominated world could play out. We cannot rely on the assumption that divesting from fossil fuels will automatically reduce global emissions fast enough because investors may switch to carbon intensive non-energy investments or renewable energy sources that cause significant emissions.

————————————

Further reading

Problems With the Math: Is 350’s Carbon Divestment Campaign Complete? (Christian Parenti) on the crucial role of state regulation and the fact that the biggest oil companies are state-owned.

Good energy, bad energy (Friends of the Earth International, November 2013)

Reclaim Power! global month of action on energy in October-November 2013

Recommended summaries on Why Green Economy?

Unburnable carbon 2013 (Carbon Tracker/LSE)

Sustainable Energy for All (SE4ALL)

Green Economy Report (UNEP)

Pingback: Why Green Economy? | What happens after we dive...

Glad this article came out because it sounds like maybe divestment movements aren’t being clear enough about what we view the impact of divesting to be: turning fossil fuel campaign contributions into dirty money, doing to Big Oil what divestment in the past two decades did to Big Tobacco. We’ve seen a global wave of anti-smoking legislation (despite knowing about the harms of smoking for half a century) in the past two decades and we think it’s linked to divestment.

Your article doesn’t mention the words “revoke the social license” anywhere, so seems to me you probably haven’t grasped the purpose of what we’re doing.

From the FAQ on our website: Can university divestment have an impact?

Personal divestment is good and university divestment is better. North American universities have an estimated endowment of $400 billion. That’s enough money to put fossil fuel industries on the defensive. McGill’s endowment and pension funds alone invest about $2 billion dollars. Most individuals can’t make that kind of difference. But it is essential to remember that divestment is not just an economic tactic.

Universities, in their role as a centre for education and research, are also the moral, ethical, scientific, and cultural beacons of our societies. Universities are a special place for the creation of a better future. When universities invest in fossil fuel companies it legitimizes them tremendously. University divestment from fossil fuel companies revokes their legitimacy, otherwise known as their “social license to operate.” We may not be able to revoke their legal license to operate through divestment but it does encourage a perception in public consciousness and discourse that fossil fuel companies who don’t meet our criteria have an illegitimate business model. This is precisely what has already happened, for example, with tobacco companies. As a result, their political power – especially in the US – has plummeted. Other ways of fighting global warming must go on in tandem. Divestment isn’t an isolated solution. Fortunately, with this divestment movement, there are movements in 300+ schools across North America asking their universities for the same thing. Together, divestment can make a big difference.

See comment on Facebook

Hi David. Interesting comparison with taking on the tobacco industry. You are right I don’t specifically mention the “social license to operate”. My article focused more on a scenario when divestment from fossil fuels has already been embraced and widely accepted across stakeholders. To get to this point there will clearly have to be a cultural shift that delegitimizes fossil fuels as an acceptable investment. So of course it is crucial to pressure universities with their special role in society to play a catalytic role in encouraging other investors to follow their lead.

Green bonds are a natural alternative for pension funds. Many triple A rated. Campaign to divest should also include a steer in this direction. But we think that will happen naturally

View conversation on Twitter

This perspective, of what investors can go for, is very useful. Divestment is closing one old path without either closing others or opening others. Suggest we need policy to reshape the entire terrain, not just campaigning on particular paths. Hence we need campaigning on the whole terrain – but isn’t this what campaigners have avoided, just like policymakers?!